The global cost of a data breach last year was USD $4.45 million. This is an increase of 15% over three years. As we step into 2024, it’s crucial to be aware of emerging technology threats. Ones that could potentially disrupt and harm your business.

Technology is evolving at a rapid pace. It’s bringing new opportunities and challenges for businesses and individuals alike. Not all technology is benign. Some innovations can pose serious threats to our digital security, privacy, and safety.

In this article, we’ll highlight some emerging technology threats to be aware of in 2024 and beyond.

Data Poisoning Attacks

Data poisoning involves corrupting datasets used to train AI models. By injecting malicious data, attackers can skew algorithms’ outcomes. This could lead to incorrect decisions in critical sectors like healthcare or finance. Some actions are vital in countering this insidious threat. These include protecting training data integrity and implementing robust validation mechanisms.

Businesses should use AI-generated data cautiously. It should be heavily augmented by human intelligence and data from other sources.

5G Network Vulnerabilities

The widespread adoption of 5G technology introduces new attack surfaces. With an increased number of connected devices, the attack vector broadens. IoT devices, reliant on 5G networks, might become targets for cyberattacks. Securing these devices and implementing strong network protocols is imperative. Especially to prevent large-scale attacks.

Ensure your business has a robust mobile device management strategy. Mobile is taking over much of the workload Organisations should properly track and manage how these devices access business data.

Quantum Computing Vulnerabilities

Quantum computing, the herald of unprecedented computational power, also poses a threat. Its immense processing capabilities could crack currently secure encryption methods. Hackers might exploit this power to access sensitive data. This emphasises the need for quantum-resistant encryption techniques to safeguard digital information.

Artificial Intelligence (AI) Manipulation

AI, while transformative, can be manipulated. Cybercriminals might exploit AI algorithms to spread misinformation. They are already creating convincing deepfakes and automating phishing attacks. Vigilance is essential as AI-driven threats become more sophisticated. It demands robust detection mechanisms to discern genuine from malicious AI-generated content.

Augmented Reality (AR) and Virtual Reality (VR) Exploits

AR and VR technologies offer immersive experiences. But they also present new vulnerabilities. Cybercriminals might exploit these platforms to deceive users, leading to real-world consequences.

Ensuring the security of AR and VR applications is crucial. Especially to prevent user manipulation and privacy breaches. This is very true in sectors like gaming, education, and healthcare.

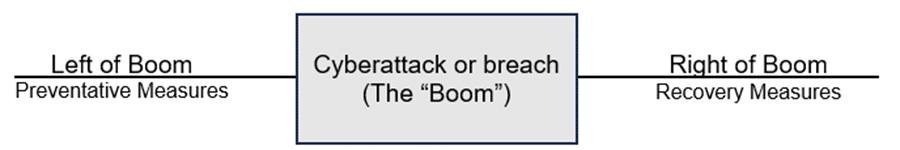

Ransomware Evolves

Ransomware attacks have evolved beyond simple data encryption. Threat actors now use double extortion tactics. They steal sensitive data before encrypting files. If victims refuse to pay, hackers leak or sell this data, causing reputational damage.

Some defenses against this evolved ransomware threat include:

- Robust backup solutions

- Regular cybersecurity training

- Proactive threat hunting

Supply Chain Attacks Persist

Supply chain attacks remain a persistent threat. Cybercriminals infiltrate third-party vendors or software providers to compromise larger targets. Strengthening supply chain cybersecurity is critical in preventing cascading cyber incidents. Businesses can do this through rigorous vendor assessments, multi-factor authentication, and continuous monitoring.

Biometric Data Vulnerability

Biometric authentication methods, such as fingerprints or facial recognition, are becoming commonplace. But users can’t change biometric data once compromised, like they can passwords. Protect biometric data through secure encryption. Ensure that service providers follow strict privacy regulations. These are paramount to preventing identity theft and fraud.

Advanced Phishing Attacks

Phishing attacks are one of the oldest and most common forms of cyberattacks. These attacks are becoming more sophisticated and targeted thanks to AI. For example, hackers customize spear phishing attacks to a specific individual or organization. They do this based on online personal or professional information.

Another example is vishing attacks. These use voice calls or voice assistants to impersonate legitimate entities. They convincingly persuade victims to take certain actions.

Ongoing employee phishing training is vital. As well as automated solutions to detect and defend against phishing threats.

Tips for Defending Against These Threats

As technology evolves, so do the threats that we face. Thus, it’s important to be vigilant and proactive. Here are some tips that can help:

- Educate yourself and others about the latest technology threats.

- Use strong passwords and multi-factor authentication for all online accounts.

- Update your software and devices regularly to fix any security vulnerabilities.

- Avoid clicking on suspicious links or attachments in emails or messages.

- Verify the identity and legitimacy of any callers or senders. Do this before providing any information or taking any actions.

- Back up your data regularly to prevent data loss in case of a cyberattack.

- Invest in a reliable cyber insurance policy. One that covers your specific needs and risks.

- Report any suspicious or malicious activity to the relevant authorities.

Need Help Ensuring Your Cybersecurity is Ready for 2024?

Last year’s solutions might not be enough to protect against this year’s threats. Don’t leave your security at risk. We can help you with a thorough cybersecurity assessment, so you know where you stand.

Contact us today to schedule a chat.

Article used with permission from The Technology Press.

Recent Comments